Federal taxes taken out of paycheck

If your Form W-4 claims that no federal income tax will be withheld from your paycheck there are many reasons why this may be the case. In fact your employer would not withhold any tax at all.

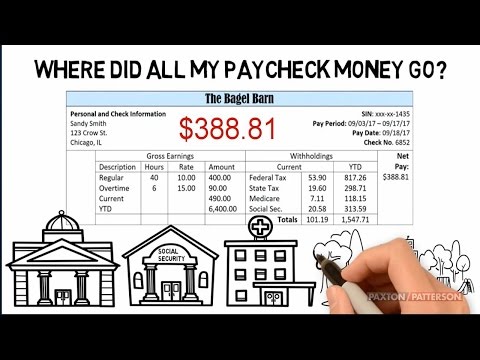

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

. How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might. Youd pay a total of 685860 in taxes on 50000 of income or 13717. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent.

You may be an. See where that hard-earned money goes - Federal Income Tax Social Security and. The federal income tax has seven tax rates for 2020.

The federal income tax has seven tax rates for 2020. The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. Your employer will also withhold money from each of your paychecks to put toward your federal income taxes.

If youre considered an independent contractor there would be no federal tax withheld from your pay. Youll pay 62 and 145 of your income for these taxes respectively. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

The federal government collects your income tax payments. The percentage of tax withheld from your paycheck depends on what bracket your income falls in. Its true that payroll taxes wont be taken out of some taxpayers paychecks beginning Sept.

10 percent 12 percent 22 percent 24 percent 32. FICA Federal Insurance Contributions Act taxes are Social Security and Medicare taxes. Your effective tax rate is just under 14 but you are in the 22 tax bracket.

There are no income limits for. The next dollar you earn. Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social.

What percentage of federal taxes is taken out of paycheck for 2020. Withholding from your paycheck is done on what is known as the graduated system. You owe tax at a progressive rate depending on how much you earn.

For example for 2021 if youre single and making between 40126 and. Your employer pays an additional 145 the employer part of the Medicare tax. Are they not taking federal taxes out of paychecks.

This tax will apply to any form of earning that sums up your income. The current tax rate for social security is 62 for the employer and. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The federal government receives 124 of an employees income each pay period for Social Security. These taxes are deducted from your paycheck in fixed percentages. Complete a new Form W-4P Withholding Certificate for Pension or.

Use this tool to. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. 4 rows Current FICA tax rates.

If this is the case. Your employer withholds 145 of your gross income from your paycheck. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck.

The percentage thats withheld will depend on things such as your income your. What percentage of federal taxes is taken out of paycheck for 2020. 1 and continuing through the end.

Understanding Your Paycheck

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Understanding Your Paycheck Youtube

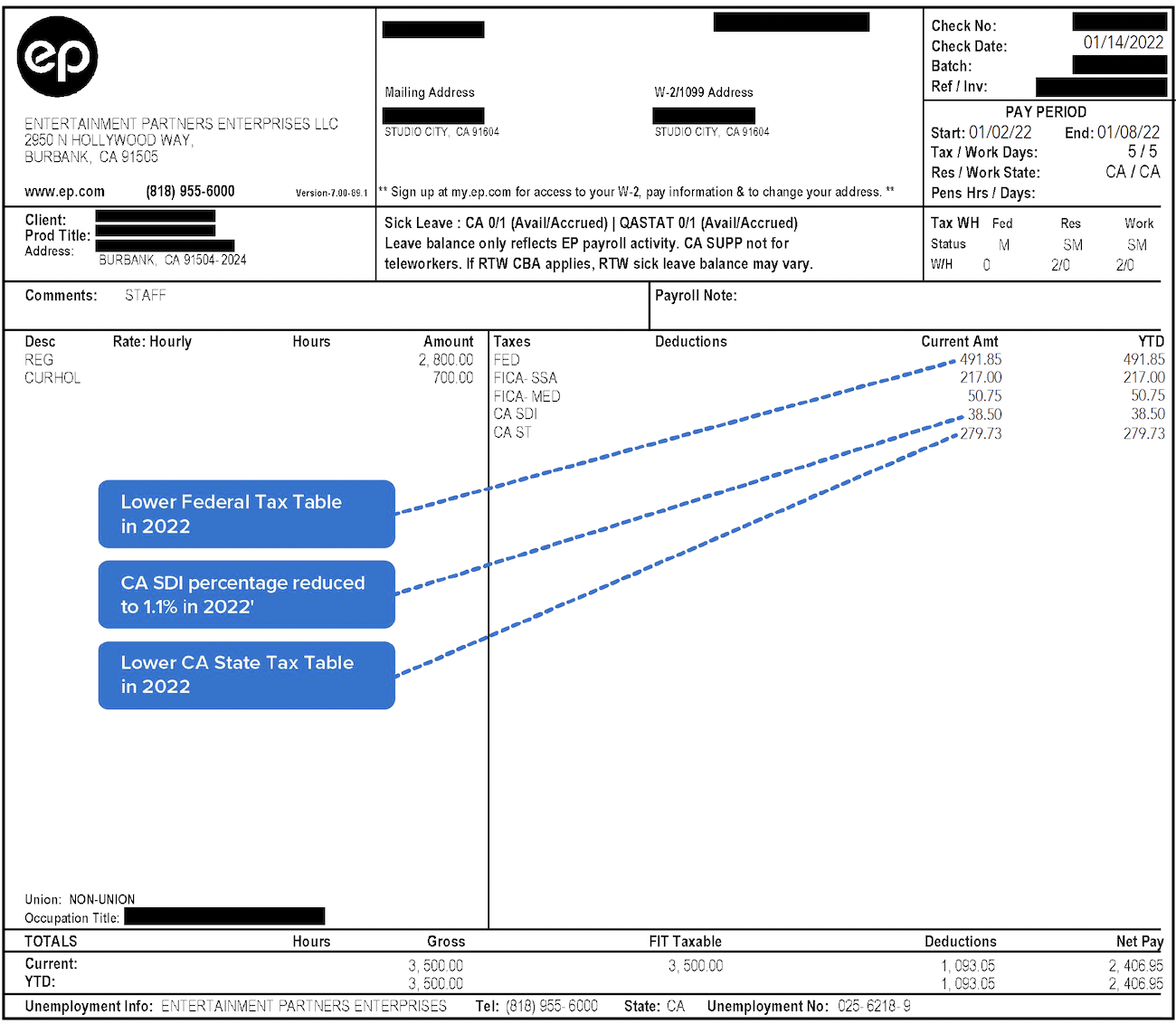

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paychecks Payroll

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

What Are Payroll Deductions Article

Decoding Your Paystub In 2022 Entertainment Partners

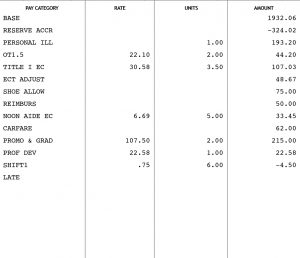

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Irs New Tax Withholding Tables

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck Credit Com

Paycheck Taxes Federal State Local Withholding H R Block

My First Job Or Part Time Work Department Of Taxation

Check Your Paycheck News Congressman Daniel Webster

How To Calculate 2019 Federal Income Withhold Manually

Here S How Much Money You Take Home From A 75 000 Salary