44+ do mortgage lenders use gross or net income

Typically you enter gross annual income in affordability calculators not net monthly. For example child support and disability.

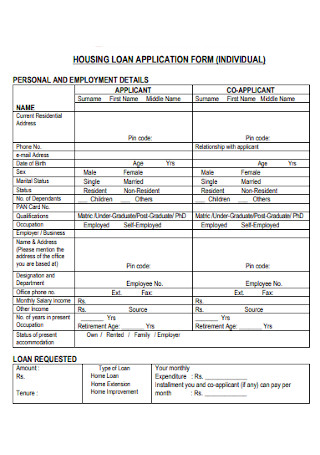

20 Sample Loan Application Form Templates In Pdf Ms Word

Web The 3545 Model.

. This rule says you. Web Some kinds of income are not subject to taxes. Web If youd put 10 down on a 555555 home your mortgage would be about 500000.

A 35 down payment. Web Lenders use gross and net business income if you dont qualify for a mortgage when they use a traditional income qualifying method. But with a full-year net loss of 275 million value investors will likely deem this stock too risky.

Web So to simplify all this mortgage companies simply ask for gross income then apply a metric that makes relatively conservative assumptions about your spending. Were Americas 1 Online Lender. Ad Were Americas Largest Mortgage Lender.

Looking For A Mortgage. Its possible to find an FHA lender willing. First its a universal application.

Its A Match Made In Heaven. Web To get approved youll need. Looking For A Mortgage.

In that case lenders are allowed to count that income as worth more. Dividing the sum of these. Its A Match Made In Heaven.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web 3 hours agoBest Mortgage Lenders. The 28 rule isnt universal.

But realistically your net income will give you a better understanding of what you can actually afford. Moreover Toast facilitated 917 billion in. Web Since your DTL ratio affects your credit score mortgage lenders may look at it as well.

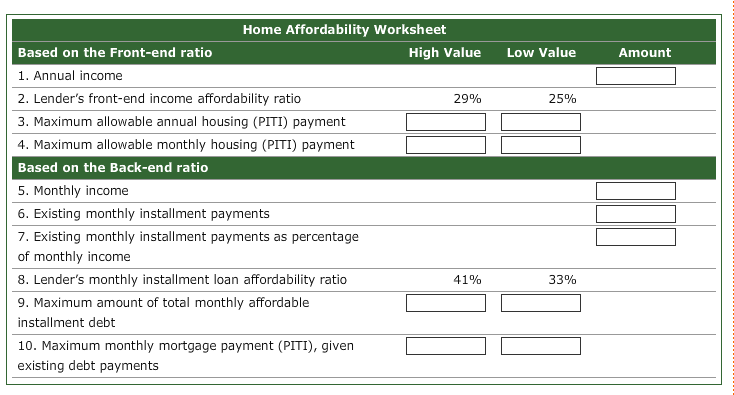

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web For example if your net income for year one was 95000 and year two 98000 the income for a qualifying mortgage will be 95000 98000 193000. Lets look at 4 different.

Lock Your Mortgage Rate Today. Everyone is qualified using the very. Web But there are a few good reasons why lenders use the gross amount instead of net pay.

Ad Were Americas Largest Mortgage Lender. Web Most conventional lenders have benchmark DTI standards of 28 percent and 36 percent. Read our financing FAQs and purchase your Pacaso second home with confidence.

Web Banks and lenders use gross income not taxable income to decide whether you qualify for a mortgage or other loan. A debt-to-income ratio below 50 percent. Web It just posted 40 gross-profit growth in the fourth quarter to 166 billion.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or.

This means that ideally you spend no more than 28 percent of your gross. Squares gross profit was up 22 to 801 million and Cash Apps up 64 to 848. Gross income is your before-tax earnings.

Ad Multiple financing options available including cash credit lines mortgages. A FICO score of at least 580. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

In that case NerdWallet recommends an annual pretax income of at least 184656. Net Income For lending purposes the debt-to-income calculation is. When you apply for a mortgage your lender will use.

Web kingstreet Forumite. Web Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income. Were Americas 1 Online Lender.

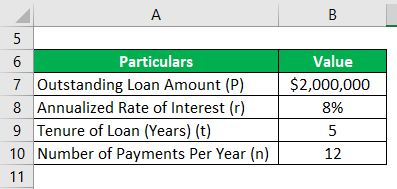

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web For example a lender would take an applicants AGI of 100000 and multiply that by three to approve the borrower for a 300000 mortgage loan. Compare Apply Directly Online.

Many lenders will take no notice of your net. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Some financial experts recommend other percentage models like the 3545 model.

Lock Your Mortgage Rate Today.

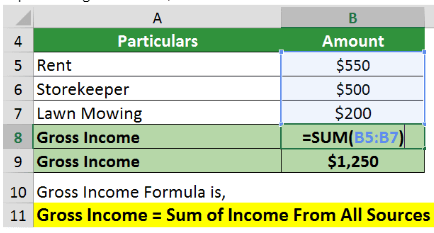

Gross Income Definition Formula Calculator Examples

What Income Can I Declare To Support A Mortgage Moneyfacts Co Uk

Do Mortgage Lenders Use Your Gross Income Youtube

Does The Bank Use Taxable Income Or Gross Income To Determine If You Qualify For A Loan

Straight Talk On Mortgages Mortgage Money

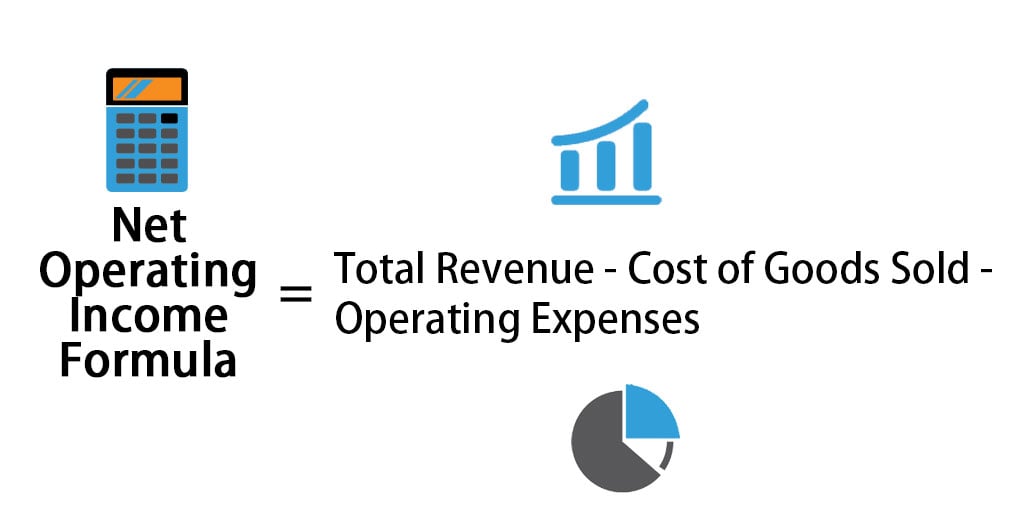

Net Operating Income Formula Calculator Examples Excel Template

2018 Black Book 364 Executives To Know Hawaii Business Magazine

Free 50 Sample Statement Forms In Pdf

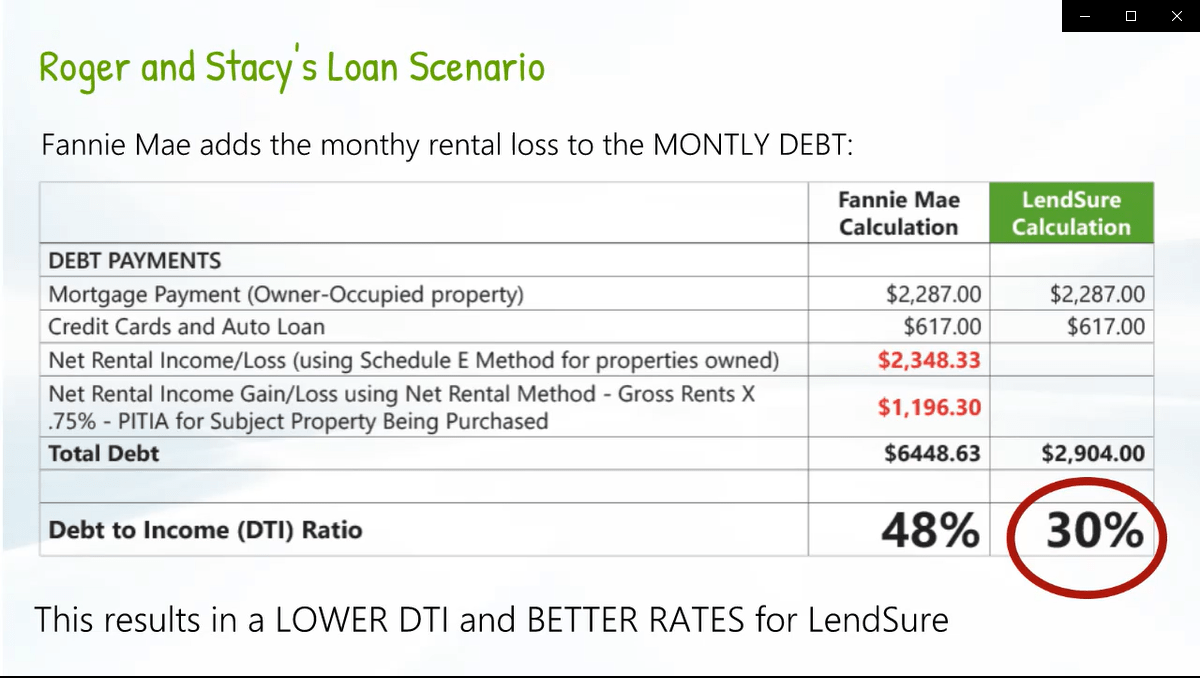

Rental Income Calculation For Better Dti Lendsure Mortgage Corp

Solved First Filling The Blank A Back End B Front End Chegg Com

Net Income Formula Calculator With Excel Template

Islam And Financial Intermediation In Imf Staff Papers Volume 1982 Issue 001 1982

Mortgage Formula Examples With Excel Template

Is Gross Or Net Income Better For Calculating Mortgage Affordability Total Mortgage

Learning Latent Representations Of Bank Customers With The Variational Autoencoder Sciencedirect

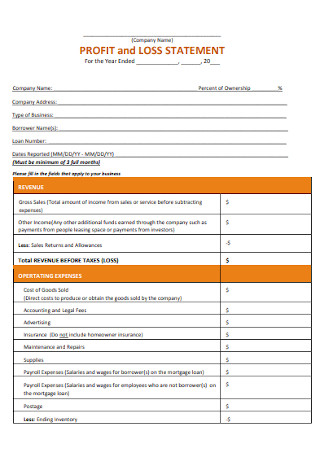

34 Sample Profit And Loss Statement Templates Forms In Pdf Ms Word

Profit Percentage Formula Examples With Excel Template